A recapitalization is an excellent vehicle for a private company owner to gain liquidity, diversify wealth, maintain operating control, and align themselves with a strong financial partner to share in the future success of the business. In some cases, the owner may prefer to transition full or partial ownership to an existing management team or next generation family member to lead the company’s next phase of growth.

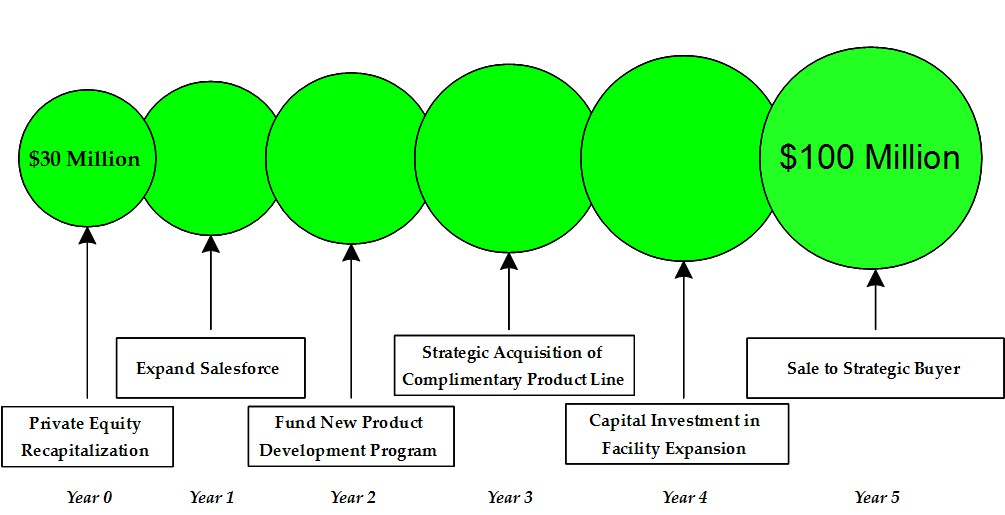

In these and similar situations, SRP Advisors believes private owners should consider a recapitalization of the business with a private equity partner. Recapitalizations unlock the value of the owner’s equity by creating substantial liquidity of their personal net worth, which promotes effective estate planning. The owner also maintains the option of retaining an equity position and remaining involved in the company’s operations, or of exiting the company completely. The private equity partner will provide the necessary financial resources to accelerate the growth of the company through both internal capital investment and/or strategic acquisitions. The owner who chooses to maintain ownership in the recapitalized company will have the opportunity to receive a “second bite of the apple” when the company is sold again in the future, usually within 4-7 years. A recapitalization can also provide the company’s senior management team with the opportunity to become equity shareholders through direct investment or the creation of stock option incentive plans.